What happened?

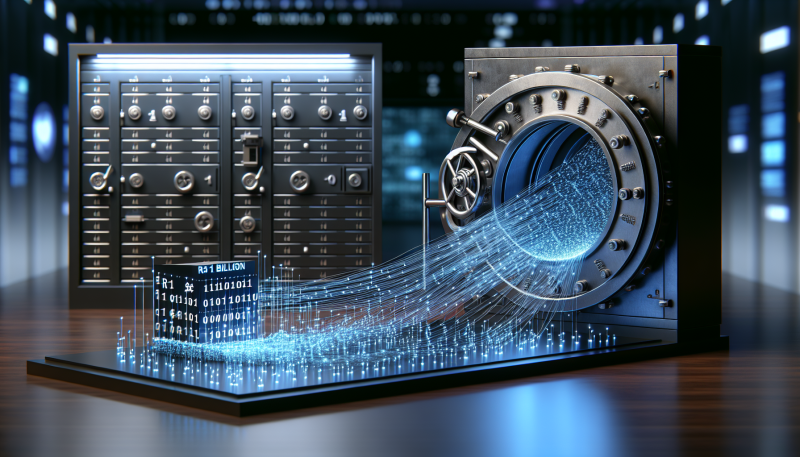

A group of criminal hackers exploited a major vulnerability in Brazil’s banking infrastructure, executing a cyberattack that resulted in the theft of over R$1 billion (~$180 million) from reserve accounts. The attack was carried out by breaching C&M Software, a Central Bank-authorized service provider responsible for API connections between financial institutions, which served as the entry point. The stolen funds were quickly funneled through cryptocurrency exchanges in an effort to convert them into Bitcoin and USDT.

Who does this affect?

This cyberattack primarily affects the institutions connected through C&M Software, including banks and financial service providers, as well as Brazil’s national payment system. Customers of the impacted banking-as-a-service provider BMP were not directly affected, although reserve funds at the Central Bank were involved. Additionally, crypto service providers were affected as they had to block transactions and freeze accounts linked to the attack.

Why does this matter?

This incident highlights significant vulnerabilities within financial infrastructures and emphasizes the risk of digital currencies being used for laundering stolen funds. The attack has substantial market implications, raising concerns about the security of banking systems and the increasing role of cryptocurrencies as tools for financial crime. It also underscores the urgent need for regulatory bodies to tighten anti-money laundering rules and improve oversight on crypto transactions to prevent similar future breaches.