What happened?

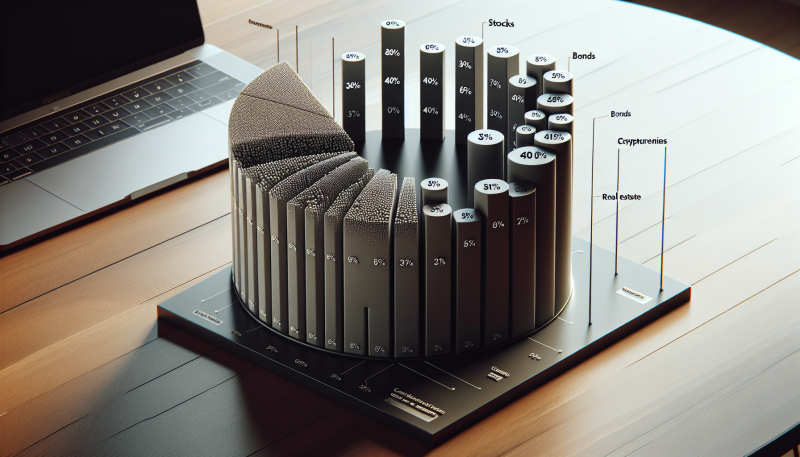

Veteran financial advisor Ric Edelman has shifted his stance on cryptocurrency investments, now recommending crypto allocations as high as 40% for portfolios. Previously, Edelman suggested a conservative allocation of just 1% due to the uncertainties surrounding crypto’s future. He believes the growing mainstream adoption and institutional interest in Bitcoin and other cryptocurrencies have resolved these past concerns, making crypto a viable asset class.

Who does this affect?

This change in recommendation primarily impacts financial advisors and their clients who are considering investment strategies. It is significant for individual investors who rely on professional advice for balancing their investment portfolios. Additionally, institutional investors and market analysts are prompted to reassess their approaches to cryptocurrency, given its increasing mainstream presence and potential returns.

Why does this matter?

Edelman’s recommendation reflects a broader shift in the financial markets, highlighting the importance of diversification as traditional portfolio splits between stocks and bonds become less effective. The inclusion of crypto, which often performs independently of traditional market trends, offers enhanced risk-adjusted returns. Growing confidence in Bitcoin’s price forecasts and the potential for high returns make crypto an attractive option, impacting how portfolios are constructed moving forward.